‘Such is life’ by Paula Steele in STEP Journal

It has been ten years since the UK’s Retail Distribution Review (RDR) was implemented, which changed the landscape for life insurance policies significantly. Many clients are unaware of what their policies provide and/or can do. [...]

‘Could life insurance be an effective solution in some circumstances for contentious trusts?’ by Jonathan Morris in ThoughtLeaders4 Private Client Magazine

Trusts serve to oversee and manage assets throughout an individual’s life and often intergenerationally, normally for tax planning or safeguarding purposes. Despite their undoubted benefits sometimes contentious situations may arise prompting trustees to consider terminating [...]

‘The Crucial Role of Women in Private Client Industry Growth’ by Alex Gibson-Watt published in IFA Magazine

The theme of this year’s International Women’s Day was to ‘inspire inclusion.’ In today’s rapidly evolving business landscape, as an industry we are increasingly realising the significance of diversity and inclusivity, with a particular emphasis [...]

Interview with Alex Gibson-Watt for The Month Magazine

Tell us a little about yourself? I’m a mother of four (now very grown up) children and wife of a very long-suffering husband. I have been involved with John Lamb in its various guises since [...]

Do you have clients with convertible term contracts? Do you know when they expire?

Convertible term policies are a commonly misunderstood section of the life insurance market. Typically, these contracts were taken out to secure a client immediate protection at a time when their cash flow was limited. The [...]

John Lamb Hill Oldridge’s team members have been recognised with awards and nominations throughout 2023

Throughout 2023, our team members have been recognised by several leading industry awards and publications. These awards demonstrate the team’s commitment to excellence in their field and their dedication to helping clients secure the most [...]

Recent contributions from the team at John Lamb Hill Oldridge in the media

Our team members are experts in their field and regularly contribute to industry-leading publications to share their knowledge and experience with others. Here are a few of the most recent contributions our team members have [...]

‘Inheritance tax considerations on the sale of a business’ by Holly Hill published in The Month magazine

In the following article, published in The Month magazine, Holly Hill, senior associate at John Lamb Hill Oldridge, explores the potential implications of the sale of a business on future inheritance tax (IHT) liability. She [...]

2 key medical underwriting trends that could benefit your clients in 2024

When arranging life insurance and income protection for your high-net-worth and ultra-high-net worth clients, it is important to understand how certain pre-existing conditions might affect their premiums. Clients who have mental health conditions or who [...]

Using life insurance as an alternative to holding assets in trust – a thought piece

In the following article, Jacob Fay, protection specialist at John Lamb Hill Oldridge, explores how life insurance can be a cost-effective alternative to holding assets in trust for high-net-worth clients and their families. Using life [...]

‘Using life insurance as a tax planning tool’ by Holly Hill in ThoughtLeaders4 Private Client Magazine

Insurance can be highly effective when used as part of the client’s cash flow management profiling on death. In this article, we demonstrate how life insurance can be used in three tax planning scenarios. Death [...]

‘Using life insurance as an alternative to holding assets in trust’ by Jacob Fay published in IFA Magazine

Within estate planning, the debate between procuring life insurance versus placing assets into trust is one that often arises. Both avenues offer distinct advantages and serve unique purposes, yet the choice between them hinges on [...]

‘Underwriting challenges of the hazardous pursuits of HNW and UHNW individuals’ by Jacob Fay published in COVER Magazine

"It is important that advisers can approach the whole market" Hazardous pursuits encompass a broad range of high-intensity activities that often involve elements of speed, height, and exposure to challenging environments. Many of these pursuits [...]

‘Simplifying life insurance for financial planning clients’ by Jonathan Morris and Darren Lee published in FT Adviser

Research suggests that confusion around life insurance is one of the reasons fewer millennials are buying policies compared to previous generations. Long-winded questionnaires and the possibility of medical screenings add to the complexity. It is [...]

Business Relief as an offset for inheritance tax: Here is how it might work

At the end of their lives, your clients are likely to want to bestow a significant amount of their wealth and assets to their family. If they have accrued a sizeable estate, their beneficiaries might [...]

Using trusts to avoid the inheritance tax liability on life insurance payouts

Life insurance is often a key component of a high net worth (HNW) client’s long-term financial protection. The policy payouts provide the liquidity to cover their inheritance tax (IHT) bill after they die, allowing their [...]

‘3 ways AI could transform the underwriting process’ by Darren Lee published in COVER Magazine

Artificial intelligence (AI) has been a regular feature in news headlines over the past year, as developments in the technology have begun to shape not only the future for many leading industries, but also the [...]

IHT planning: Interview with Jonathan Morris and IFA Podcast

Our Senior Associate, Jonathan Morris, spoke with Brandon Russell and Sue Whitbread about a crucial part of your clients’ estate planning - IHT planning. They also discussed PETs and the importance of gift cover. As a specialist in these [...]

Money Marketing in conversation with Ken Maxwell…wealth protection for HNW and UHNW individuals

The Money Marketing Podcast is a definitive guide to the biggest issues in financial planning and, recently, our Director, Ken Maxwell, spoke with Kimberley Dondo for their latest episode. They covered: ▪️ Wealth protection for [...]

Paula Steele has been featured in the Spear’s 500

We are delighted that our Director, Paula Steele, has been featured in the Spear’s 500, a guide to the top private client advisers and service providers for HNW individuals. She has also been ranked as a [...]

Citywealth leaders list interview: 60 seconds with Paula Steele

Our Director, Paula Steele, was interviewed by Citywealth about her role at John Lamb Hill Oldridge, and life outside our Boswell Street office. They discussed topics including: • Her role • A typical day at work • Interesting [...]

John Lamb Hill Oldridge launches a Renewal and Valuation Service for life insurances

LONDON, 13th September 2023 John Lamb Hill Oldridge is delighted to announce the launch of its Renewal and Valuation Service for life insurance policies. Clients, Trustees and Advisers face a myriad of issues where they [...]

Family Income Benefit: a fantastic protection solution for divorcing clients

Family Income Benefit: a fantastic protection solution for divorcing clients Divorce can have a significant impact on a family's financial stability, making it crucial to ensure that both parties involved, as well as any dependents, [...]

Holly Hill shortlisted for prestigious award, and more in your latest update

Professional accolades are a great way of showcasing to our clients the level of professionalism and expertise we bring to our work — and the recognition it has received from the wider industry. The past [...]

How we have been getting the word out through industry publications

John Lamb Hill Oldridge regularly features in many prominent trade publications. Our team write informative pieces that have offered our expert insights into the world of protection. Here are a few topics they have covered. [...]

Guaranteed whole-of-life assurance: here is why it might be an attractive option

Guaranteed whole-of-life assurance contracts have come back into the limelight recently. They offer high internal rates of return guaranteed not only by the issuing insurer, but also by the Financial Services Compensation Scheme (FSCS), which [...]

‘Female entrepreneurs in the private client industry’ by Alex Gibson-Watt

The private client industry has a reputation for being male dominated, however there are many, very successful and entrepreneurial women at the forefront of the industry who are driving change [...]

Holly and Jonathan promoted to Senior Associate

We are delighted to announce that our Brokers, Jonathan Morris DipPFS and Holly Hill DipPFS Hill, have been promoted to Senior Associate. This is in recognition of their significant and sustained contribution to the [...]

‘Five reasons why people don’t think life insurance is for them…and why they might be wrong’ by Jacob Fay in COVER Magazine

Our broker, Jacob Fay, has recently published an article with COVER Magazine. COVER is the leading industry publication for life protection and health insurance. In the article, Jacob identifies five of the [...]

John Lamb Hill Oldridge won UHNW Private Client Services of the Year (Gold) 2023

We are delighted to announce that John Lamb Hill Oldridge won UHNW Private Client Services of the Year (Gold) for the second year in a row! Last night, Alex Gibson-Watt and Ken [...]

Does protection get the level of attention that it requires? Podcast by Ken Maxwell in IFA Magazine

In a recent episode of the IFA Talk Podcast, our director, Ken Maxwell, joined Sue Whitbread and Brandon Russell to discuss the importance of client protection. During the interview, Sue brought up an interesting [...]

‘How can a gift inter vivos policy protect you from a potential inheritance tax liability?’ by Holly Hill published in FT Adviser

When making gifts to your loved ones, it is important to consider whether your generosity may also be exposing you to a substantial 40% Inheritance Tax (IHT) charge. Let's [...]

Paula Steele “In the Spotlight” feature for The Month, Private Client Global Elite’s exclusive magazine

We are pleased to announce that Paula Steele’s “In the Spotlight” feature for The Month, Private Client Global Elite’s exclusive magazine, has now been published. In the piece, Paula shares: • [...]

International Women’s Day… Alex Gibson-Watt comments in IFA Magazine

Female entrepreneurs in the private client industry International women’s day provides an opportunity to not only reflect but also to look forward on the progress that women have made in [...]

Holly Hill has been shortlisted for the COVER Magazine Women in Protection & Health Awards 2023

We are delighted to announce that our Broker, Holly Hill, has been shortlisted for the COVER Magazine Women in Protection & Health Awards 2023. This year, there were a staggering 50% more outstanding [...]

Paula Steele comments about ‘Property and life insurance: issues for UHNWIs’ in Citywealth

Our Broking Director, Paula Steele, recently spoke with Citywealth to consider the latest updates in the property sector and how UHNWIs are coping with the changing landscape. The piece covered: • Taxes and [...]

‘3 powerful reasons indexation should be a priority for your clients in 2023’ in IFA Magazine by Holly Hill

Soaring inflation has affected many aspects of everyday life over the past 12 months, from grocery bills to mortgage rates. A less obvious but potentially damaging consequence is the gap [...]

Paula Steele and Ken Maxwell listed again this year in the Private Client Global Elite Directory 2023

We are delighted to announce that our Broking Directors, Paula Steele and Ken Maxwell, have been listed once again this year in the Private Client Global Elite Directory. The Private Client Global Elite is a [...]

Meet the newest member of our team, Jacob Fay.

Meet the newest member of our team - Broker, Jacob Fay. Jacob graduated from Exeter University with a 2:1 in Human Geography last August, focusing his dissertation on the portrayal of [...]

Why we are excited for the Magic Circle Awards and the latest company news

Citywealth magazine’s Magic Circle Awards are the leading accolade in the wealth management sector. The 2023 event is due to be held in London on 17th May with voting closing on 10th March. At [...]

The latest facial recognition technology: 3 reasons it might improve underwriting and benefit client wellness

Since the invention of the computer and the advent of the internet, technology has rapidly progressed, filtering into our everyday lives and changing the way our society functions on a daily basis. The pandemic [...]

Death and taxes: Why IHT problems might be solved by valuable protection

Death and taxes are two issues that all of our clients are guaranteed to face and it is highly likely that inheritance tax (IHT) in particular will make up a considerable part of their [...]

What cancer diagnosis delays mean for the life insurance market and how it can affect your clients’ cover

The last few years of global events have felt like a series of dominos colliding as each new issue inevitably gives rise to a further problem. It has made for an unforgiving and uncertain [...]

INSURANCE PREMIUM TABLES FEBRUARY 2023

Our latest insurance premium table dated from February 2023 is now available for download. This useful reference guide includes rates for Whole of Life, Fixed Term, Gift Inter Vivos, Business Protection and Relevant Life policies. Download Rates [...]

Paula Steele on the judging panel for the Magic Circle Awards 2023

Our Director, Paula Steele, has accepted an invitation to sit on the judging panel for The Magic Circle Awards 2023. This is a well-deserved acknowledgement of Paula’s reputation, expertise and [...]

How can you make sure valuable assets remain in your family and not with HMRC’ by Jonathan Morris in Polo & Lifestyle the London Magazine

If you have significant assets, it is likely that you will want to pass these on to your family at some point. In recent years, the UK tax authorities have [...]

Holly Hill awarded Bronze for Financial Advisory Individual of the Year at the Future Leaders Awards 2022 by Citywealth

We are delighted to announce that Holly Hill was awarded Bronze for Financial Advisory Individual of the Year at the Future Leaders Awards 2022 by Citywealth! This is a fantastic achievement for [...]

Ken Maxwell and John Lamb Hill Oldridge shortlisted in the Magic Circle Awards 2023

We are delighted to announce that Ken Maxwell and John Lamb Hill Oldridge have been shortlisted across two categories in the Magic Circle Awards 2023 by Citywealth! Ken is a finalist for the Wealth Professional [...]

‘Estate planning for high-net-worth clients: life insurance as a cost-effective strategy’ in IFA Magazine by Holly Hill

A cost-effective inheritance tax (IHT) strategy is a vital part of long-term estate planning. It is especially important for high-net-worth clients, for whom the tax implications of poor planning [...]

‘Should a client take a rated quote’ in COVER Magazine by Jonathan Morris

"As time passes, there is an increasing risk of further health issues arising" Jonathan Morris, protection specialist at John Lamb Hill Oldridge, examines the considerations of increased premiums known [...]

How we’ve ended our year with success at the Future Leader Awards and charity at the St Christopher’s Goldsmith dinner

At the end of an eventful year for John Lamb Hill Oldridge, we reflect on our awards success and time in the media spotlight, continued recognition of our place as the UK’s foremost specialist [...]

How the pandemic has affected life insurance rates and what your clients need to know

The consequences of the pandemic have been widespread throughout society and the insurance industry has not been shielded from the effects. Prior to the pandemic, insurance premiums were at historically low rates Following the [...]

‘Is your client’s work-place income protection policy doing the job?’ in Professional Adviser by Jonathan Morris

Is your client’s work-place income protection policy doing the job? Why do your clients need income protection? With the cost of living increasing, the requirement for long term financial [...]

The service and expertise of John Lamb Hill Oldridge has been celebrated at key awards and in the press

We are delighted to announce that our director, Paula Steele, follows up her silver Lifetime Achievement Award at the Citywealth Magic Circle Awards by being selected as a judge for the 2023 ceremony. It [...]

3 valuable lessons for dealing with the fallout from divorce

Divorce can be an emotionally draining process with the fallout affecting separating spouses in a variety of ways. When couples marry, they typically merge their respective lives and, in the event of divorce, the [...]

Citywealth leaders list interview: 60 seconds with Paula Steele

Our Director, Paula Steele, was interviewed by Citywealth about her role at John Lamb Hill Oldridge, and life outside our Boswell Street office. They discussed topics including: • Her role • A typical day at work • [...]

Assisting a client who was seeking further cover via convertible term policies

A man in his 70s and a woman in her 60s with a property worth £4 million. Their existing lifetime mortgage of £1.6 million had a relatively high interest rate of just above 7%, which meant that the amount owing was increasing rapidly. The couple were concerned about the loss of equity from their property.

Extending convertible term assurance for a client with medical considerations

A man in his 70s and a woman in her 60s with a property worth £4 million. Their existing lifetime mortgage of £1.6 million had a relatively high interest rate of just above 7%, which meant that the amount owing was increasing rapidly. The couple were concerned about the loss of equity from their property.

Covering a prenuptial payment with a convertible term policy

A man in his 70s and a woman in her 60s with a property worth £4 million. Their existing lifetime mortgage of £1.6 million had a relatively high interest rate of just above 7%, which meant that the amount owing was increasing rapidly. The couple were concerned about the loss of equity from their property.

Arranging maintenance cover for a divorced client

A man in his 70s and a woman in her 60s with a property worth £4 million. Their existing lifetime mortgage of £1.6 million had a relatively high interest rate of just above 7%, which meant that the amount owing was increasing rapidly. The couple were concerned about the loss of equity from their property.

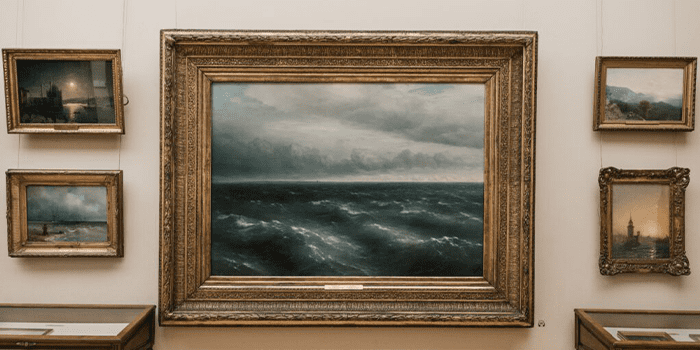

‘Keeping art and luxury items in the family’ in The Month magazine by Jonathan Morris

Art and luxury items are bought for a variety of reasons; sometimes as a store of value, sometimes with a view to capital gain, but often, simply because the purchaser loves what they’re buying. [...]

INSURANCE PREMIUM TABLES AUGUST 2022

Our latest insurance premium table dated from August 2022 is now available for download. This useful reference guide includes rates for Whole of Life, Fixed Term, Gift Inter Vivos, Business Protection and Relevant Life policies. Download Rates [...]

“Keep it in the family” – download our comprehensive new Inheritance Tax guide now

Conversations about money are rarely easy or straightforward, particularly when family is involved. Despite this, it’s important for your clients to start talking about passing on wealth early in life so that they can [...]

Why it’s so important to seek specialist advice when arranging high-net-worth life insurance

For most people, life insurance is an important part of protecting their family and other dependents. For a high-net-worth (HNW) individual with major financial commitments, obtaining the appropriate level of cover is even more vital. [...]

More awards success for John Lamb Hill Oldridge as Paula wins Lifetime Achievement Award

We are excited to announce that our director, Paula Steele, has won a silver Lifetime Achievement Award at the prestigious Citywealth Magic Circle Awards 2022. This is a huge and well-deserved accolade for Paula, [...]

The challenges of writing high net worth life insurance’ in COVER Magazine by Ken Maxwell

Our Director, Ken Maxwell, recently spoke with COVER Magazine about the challenges of writing high net worth life insurance. COVER is the leading industry publication for life protection and health insurance, providing expert news, [...]

Paula Steele in the final shortlist in Professional Adviser’s in Financial Advice Awards 2022

We’re thrilled to announce that our Director, Paula Steele, has reached the third and final shortlist for Woman of the Year - Protection Advice in Professional Adviser’s Women in Financial Advice Awards 2022. These [...]

Re-mortgaging a lifetime mortgage to a cheaper rate

A man in his 70s and a woman in her 60s with a property worth £4 million. Their existing lifetime mortgage of £1.6 million had a relatively high interest rate of just above 7%, which meant that the amount owing was increasing rapidly. The couple were concerned about the loss of equity from their property.

Elderly client obtains a lifetime mortgage to pay for care costs

A man aged in his 80s with a property worth £750,000 and a mortgage for £150,000 secured against it. The client had minimal income, but because of his care needs, he was spending £22,000 per year on his care (while remaining in the property) and on the costs of running the home. His savings were being rapidly depleted by these ongoing costs, even though his family were providing financial assistance. Another brokerage firm had already said that it could not assist him, and he was increasingly worried that he would be forced to leave his home.

Lifetime mortgage for consolidation of debts and home improvements

A single woman in her 60s with a property valued at £400,000. The client had £25,000 in credit card and loan debt. It was costing her £600 per month to repay these debts, so this was having an impact on day-to-day living, even though her monthly income was £1,800. She also wanted to carry out some home improvements but had no savings and was unable to obtain further credit due to her impaired credit history.

Re-mortgaging a lifetime mortgage to a more beneficial arrangement

A recently widowed man in his 80s. His existing lifetime mortgage had an interest rate above 6% and there was no facility to make fee-free repayments due to being an older product, which was far from an ideal arrangement. He was also due to inherit a large cash lump sum and wanted to use some of this to reduce the debt secured against his property

Assisting a client who was in difficulty due to a lack of income

A retired woman in her late 70s, finding that her income was not sufficient to cover her outgoings. Client’s financial difficulties had led to her accumulating debts and experiencing stress and illness. Friends and neighbours had been providing financial support as the situation worsened as she had no longer had any family.

Re-mortgaging from an interest only mortgage to a lifetime mortgage

A married couple in their early 70s, who had recently retired after selling their business. Their interest-only mortgage would shortly come to an end. Although they now had large savings and individual pension funds, they did not have sufficient regular income to meet the affordability requirements needed for a standard residential mortgage.

Key person insurance for a company director

The client was a 42-year-old non-smoker who was resident in the UK and who was the director of a company. The client had bought out his business partner via an equity fund. The company’s board had decided that the individual needed to take out key person insurance to protect the business, as there could be significant consequences if he were to die unexpectedly or be incapacitated by illness.

Arranging high-value life insurance for business customers

The clients are a couple, with the husband in his 60s and the wife in her 40s. They are both UK residents and non-smokers. They were seeking to restructure the business they own jointly. The husband has health issues. The couple had lost their Business Property Relief qualification for a period of two years.

Assisting a couple facing a potential large inheritance tax liability by arranging suitable life insurance

The clients were a couple, both in their 60s, who were British nationals and resident in the UK. The couple’s estate is valued at £10 million. Their individual nil rate bands of £325,000 each could not be used in this case, and they were therefore facing the prospect of inheritance tax of 40% being charged on the full amount once the second client died, which would mean a £4 million IHT bill for their nearest and dearest at that time.

Providing life insurance with a high sum assured for a non-domiciled individual

The client is in his 40s, resident in the UK, but not considered to be domiciled in the UK. His family lives in Kuwait. We were unable to obtain sufficient cover for this client in the UK market because, although he had extensive investment income, he did not have any earnings from employment or self-employment in the UK as his business was still in the start-up phase. For this reason, he was referred to a US-based broker with whom we have worked closely on many occasions.

John Lamb Hill Oldridge has been shortlisted for the Magic Circle Awards and Citywealth Powerwomen Awards

There’s still time to vote for John Lamb Hill Oldridge and for the members of our team who have received deserved nominations for prestigious financial services awards. We would be very grateful for your [...]

Providing Protection Against Inheritance Tax Liabilities For A Trustee

The clients are UK trustees of a UK resident trust. The life assured is a UK resident and domicile in his 50s who is the life tenant of a trust. After John Lamb Hill Oldridge placed £90 million of cover in the UK market, the trustees still had another £60 million of potential IHT liability to cover.

Convertible Term Policy To Cover A Pre-nup Payment

The client is a man his 30s, UK resident and a non-smoker. As a condition of his pre-nuptial agreement, his spouse was entitled to receive a £10 million payment were he to pass away. Much of his family’s wealth is tied up in trusts, and by seeking life insurance, the client was seeking to avoid a potential claim that would disrupt the family’s investment strategy by forcing them to liquidate their positions at an inopportune time.

Arranging Life Cover To Mitigate Any Potential IHT Liability Should A Client Die After Making A Gift

The female client was in her 70s and was both resident and domiciled in the UK. The client wished to make a gift of £11 million to her children. After using her nil rate band, the potential inheritance tax liability on the gift was calculated at more than £4 million – the size of this gift meant that there was no question of being able to use any of the available gift allowances

Assisting A Couple Facing A Potential Large Inheritance Tax Liability By Arranging Suitable Life Insurance

The clients were a couple, both in their 60s, who were British nationals and resident in the UK. The couple’s estate is valued at £10 million. Their individual nil rate bands of £325,000 each could not be used in this case, and they were therefore facing the prospect of inheritance tax of 40% being charged on the full amount once the second client died, which would mean a £4 million IHT bill for their nearest and dearest at that time.

Arranging A Life And Critical Illness Policy For A Client With An Extensive Medical History

Like millions of people across the UK, this 40-year-old client approached us seeking to put in place comprehensive cover to provide funds for their family should they pass away, and to provide funds to meet the costs of medical care and home conversions should they contract a critical illness. The desired sum insured was £200,000. However, obtaining appropriate cover for this client was not entirely straightforward, as they had what could be described as an ‘extensive’ medical history, having had a number of medical issues at different stages of their lifetime.

Arranging Life Insurance To Mitigate Inheritance Tax Risks For A Younger Customer

John Lamb Hill Oldridge is proud to be able to assist customers at every stage of their financial journey. In this instance, the client is a 25-year-old man who had been gifted as much as £5 million in non-income producing assets, and who was referred to us by his accountant. As the client had other assets that exhausted his nil-rate inheritance tax band, he was liable for inheritance tax at the full rate of 40% on the entire £5 million, which equates to £2 million.

JOHN LAMB HILL OLDRIDGE SHORTLISTED FOR THE 2022 CITYWEALTH POWERWOMEN AWARDS

We are delighted to announce that John Lamb Hill Oldridge have been shortlisted for the 2022 Citywealth Powerwoman awards as “Company of the Year – Female Leadership (Boutique)”. This nomination is not only a [...]

KEN MAXWELL APPOINTED AS DIRECTOR

John Lamb Hill Oldridge is delighted to announce that they have expanded the Board of Directors with Ken Maxwell being appointed as Director. Since joining John Lamb Hill Oldridge in 2018 Ken has been [...]

INSURANCE PREMIUM TABLES MAY 2021

Our latest insurance premium table dated from May 2021 is now available for download. This useful reference guide includes rates for Whole of Life, Fixed Term, Gift Inter Vivos, Business Protection and Relevant Life policies. Download Rates Table [...]

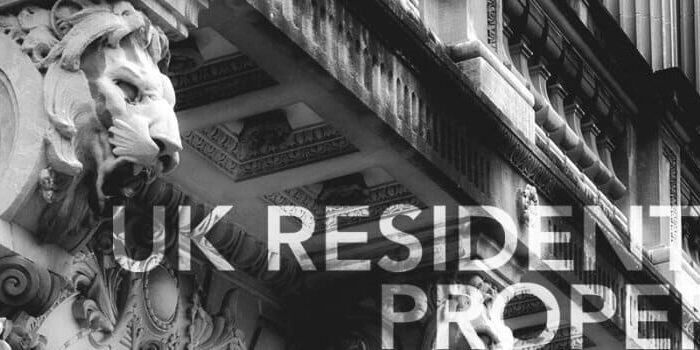

UK REAL-ESTATE AND THE REGISTER OF FOREIGN OWNERS

UK REAL-ESTATE AND THE REGISTER OF FOREIGN OWNERS: BE PREPARED FOR NEW REGISTRATION REQUIREMENTS. As a transparency measure, the Government is set to introduce a Register of People with Significant Control over Overseas Companies [...]

REDUCE IHT ON YOUR LONDON PROPERTY: AN INTERVIEW WITH MICHELLE CARTWRIGHT

Our international insurance specialist, Michelle Cartwright, recently had the pleasure of being interviewed by Jeremy McGivern of Mercury Homesearch. Jeremy was interested in finding out how individuals can legally avoid facing a large IHT bill [...]

INSURANCE PREMIUM TABLES FEBRUARY 2021

Our latest insurance premium table dated from February 2021 is now available for download. This useful reference guide includes rates for Whole of Life, Fixed Term, Gift Inter Vivos, Business Protection and Relevant Life policies. Download Rates [...]

NEW UK REGISTER TO IDENTIFY FOREIGN OWNERS OF PROPERTY

NEW UK REGISTER TO IDENTIFY FOREIGN OWNERS OF PROPERTY WILL EXPOSE BRITISH EXPATS AND OVERSEAS NATIONALS TO MAJOR INHERITANCE TAX HIT At a glance New register of overseas entities that own UK property comes [...]

MERRY CHRISTMAS FROM JOHN LAMB HILL OLDRIDGE

Christmas and New Year are always a period of reflection and never more so as we say goodbye to 2020. Whilst there have been unimaginable challenges both on professional and personal levels, there have also [...]

JOHN LAMB HILL OLDRIDGE IN THE PRESS

Unlike others in our industry we kept working through lockdown and all that COVID-19 has thrown at us. We have taken pride in the fact that we have continued to provide the same level of advice and service our clients expect. We are very aware that our clients’ personal needs don’t sit still just because we are not in an office together or having to socially distance; technology has enabled us to stay on top of our brief.

INSURANCE PREMIUM TABLE JULY 2020

Our latest insurance premium table dated from July 2020 is now available for download. This useful reference guide includes rates for Whole of Life, Fixed Term, Gift Inter Vivos, Business Protection and Relevant Life policies. Download Rates [...]

JOHN LAMB MERGES WITH HILL OLDRIDGE

HILL OLDRIDGE JOINS JOHN LAMB CREATING THE UK’S LEADING LANDED ESTATES ADVISER ADVISER TO OVER 150 OF THE UK’S BIGGEST LANDED ESTATES AND THEIR FAMILIES. Hill Oldridge, a leading life assurance adviser to families [...]

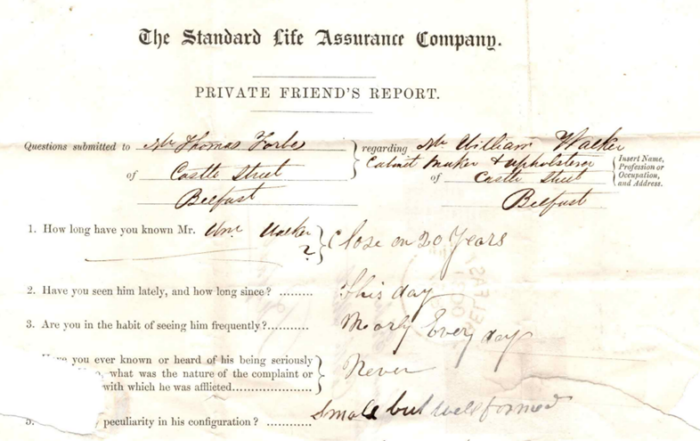

JULIAN HILL – IN MEMORIAM

Julian Hill, who founded Hill Oldridge, passed away earlier this year. He will be sadly missed by all those who knew him. REMEMBERING JULIAN HILL by David Pollock Julian left school in 1978 and, [...]

EQUITY RELEASE PREMIUM TABLE JUNE 2020

Our latest equity release premium rates are now available for download. This useful reference guide includes an overview of types of equity release along with product standards and features. Download Rates Table [...]

INSURANCE PREMIUM TABLE JUNE 2020

Our latest insurance premium table dated from June 2020 is now available for download. This useful reference guide includes rates for Whole of Life, Fixed Term, Gift Inter Vivos, Business Protection and Relevant Life policies. Download Rates Table [...]

BUSINESS AS USUAL – WELL, NEARLY!

Spring has most certainly sprung and at John Lamb it is business as usual; we continue to provide expert, specialist advice to our clients and professional friends as we always have done. However, the [...]

HELPING TO NAVIGATE UNCERTAIN TIMES

The last few weeks have been full of highs and lows. I feel like that’s just the way the world will be for the next few weeks or months, lots of difficult moments, flecked [...]

BUSINESS GOES ON – THE WORLD KEEPS SPINNING

Now that most of us are spending most – if not all – of our time at home, the John Lamb Team, have been dealing with the challenges of TEAMS, conference calling and a degree of [...]

EQUITY RELEASE CAN PROVIDE MUCH NEEDED SUPPORT IN THESE CHALLENGING TIMES

Equity Release can be a powerful tool for helping people meet their financial objectives in later life. However, the potential advantages of Equity Release have taken on a renewed significance in light of the [...]

COVID-19: YOU ARE NOT ALONE

WE ARE HERE TO HELP With the uncertainty and upheaval we all face due to the outbreak of COVID-19 (Coronavirus), I wanted to update you directly on the actions we are taking at John [...]

INSURANCE PREMIUM TABLE JANUARY 2020

Our latest insurance premium table is now available for download. This useful reference guide includes rates for Whole of Life, Fixed Term, Gift Inter Vivos, Business Protection and Relevant Life policies. Download Rates Table

INTERNATIONAL LIFE INSURANCE

For most UK residents, purchasing life insurance is relatively simple. However, for those living and/or working abroad, obtaining life insurance can be complicated and expensive. Certain UK providers and offshore insurers offer cover for [...]

IHT ON UK RESIDENTIAL PROPERTY – A BRIEF UPDATE

We’ve been watching with interest to see the outcome of the discussion between HMRC and the collective of professional bodies who questioned HMRC’s interpretation of the 2015 legislation around changes to inheritance tax charges [...]

INSURANCE PREMIUM TABLE

Our latest insurance premium table is now available for download. This useful reference guide includes rates for Whole of Life, Fixed Term, Gift Inter Vivos, Business Protection and Relevant Life policies. Download Rates Table

IS IT POSSIBLE TO GET LIFE COVER IF YOU SUFFER FROM MENTAL ILLNESS?

This week is mental health awareness week, with a particular focus on ‘stress and how we cope.’ We at John Lamb Insurance Broking are experts in obtaining excellent terms on those who have a [...]

WHY SHOULD YOU CARE ABOUT INHERITANCE TAX?

"WHEN I DIE AND AM BURIED, IT WON'T MATTER ANYMORE AND IT WON'T BE MY PROBLEM" Approaches to Inheritance Tax (IHT) range from the laissez-faire, leave it to the children, attitude to the [...]

JOHN LAMB INSURANCE BROKING WINS FINTECH AWARD 2018

John Lamb Insurance Broking is very pleased to have been awarded Insurance Brokerage Advisory Firm of the Year – UK in the 2018 Finance Monthly Magazine FinTech Awards. The Finance Monthly Fintech Awards acknowledge [...]

JOHN LAMB RECEIVES SILVER AT POWERWOMEN AWARDS 2018

John Lamb is delighted to have won the Silver award for Company of the Year – Female Leadership (SME) at the 2018 Citywealth Powerwomen awards. Many congratulations to all the winners!

CITYWEALTH LEADERS LIST 2017

We are delighted to announce that Paula Steele our Managing Director has once again been included in the Citywealth Leaders List. The Citywealth Leaders List is a best of the best directory of leading professionals [...]

MAGIC CIRCLE AWARDS 2017

We are delighted to announce that Paula Steele our Managing Partner has been shortlisted in the Magic Circle Awards 2017 as Entrepreneurial Individual of the Year. The Magic Circle Awards are held annually to find [...]